Trading Like Wyckoff: How to Spot Smart Money Moves

Written by Arbitrage • 2025-08-20 00:00:00

If you've ever felt like the market is rigged against you, you're not wrong. The truth is, institutions and large players - what Wyckoff called the "Composite Man" - are the ones moving markets. Retail traders usually find themselves reacting, not anticipating. That's where the Wyckoff Method comes in. Richard D. Wyckoff developed a framework to decode market behavior and spot the footprints of smart money. By learning his method, you can stop chasing price and start trading in alignment with the big players.

Who Was Wyckoff and Why It Matters

Richard Wyckoff was a trader and educator in the early 1900s who studied how professional money operated in the markets. He believed that if you learned to think like the "Composite Man," you could understand where the market was heading. His framework is just as relevant today. Whether you're trading stocks, futures, or crypto, price still moves based on supply and demand - and smart money still leaves clues.

The Core Principles of the Wyckoff Method

- The Law of Supply and Demand: Prices rise when demand > supply, and fall when supply > demand. Look at price and volume together to see which side dominates.

- The Law of Cause and Effect: Periods of consolidation (the "cause") lead to breakouts or breakdowns (the "effect"). The longer the base (accumulation or distribution), the larger the potential move.

- The Law of Effort vs. Result: Volume (effort) should confirm price movement (result). If price pushes higher on weak volume, it's often a trap. If volume surges but price stalls, smart money may be offloading.

These principles are the foundation. They help you stop guessing and start interpreting what's actually happening behind the candles.

The Market Cycle According to Wyckoff

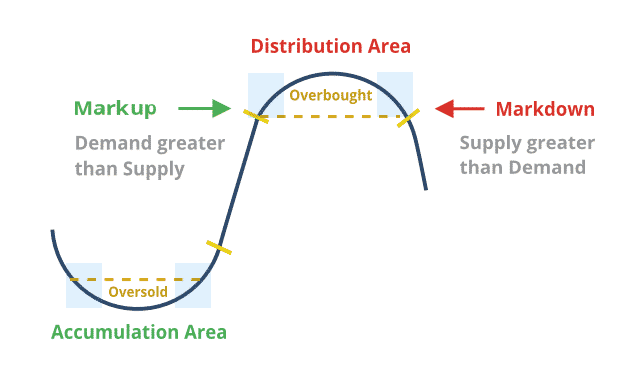

Wyckoff broke the market into four repeating phases:

- Accumulation - Smart money buys quietly after a downtrend. Price moves sideways as supply gets absorbed.

- Markup - Once enough inventory is built, price breaks out. Retail traders pile in, fueling the trend.

- Distribution - Institutions sell into strength. Price forms a range again, but this time supply is building.

- Markdown - Price breaks down, and retail traders are left holding the bag.

As a trader, your goal is simple: buy during accumulation, sell during distribution.

Spotting Smart Money Moves in Real Time

Wyckoff created schematics (blueprints) for accumulation and distribution. While every chart is unique, here's what to look for:

- Springs and Shakeouts - False breakdowns designed to trigger stop-losses before price reverses higher.

- Upthrusts (UTAD) - False breakouts that trap breakout buyers before reversing lower.

- Volume Clues - Pay close attention when price makes a strong move but volume doesn't confirm. That's often the Composite Man tipping his hand.

A practical tip: When you see a sideways range after a big move, don't assume it's random. Ask: is this accumulation (smart money buying) or distribution (smart money selling)? The answer determines the next major trend.

How to Apply Wyckoff in Your Trading

- Use Wyckoff for Entries and Exits: Buy near the end of accumulation when demand confirms. Sell or short at the end of distribution when supply takes over.

- Pair Wyckoff With Modern Tools: Moving averages or RSI can help confirm momentum. Volume Profile can make Wyckoff's supply/demand analysis even clearer.

- Risk Management Is Key: Don't assume every sideways range is accumulation. Always wait for confirmation before committing capital.

Think of Wyckoff as your lens to read the market, not as a rigid rulebook.

Common Mistakes to Avoid

- Forcing Patterns - Not every range is a Wyckoff setup.

- Ignoring Volume - Wyckoff is volume-driven; without it, the story is incomplete.

- Jumping in Too Early - Patience is critical. Smart money takes time to build positions, and you should too.

Conclusion

The Wyckoff Method isn't about predicting the future; it's about understanding how the market really works. By studying accumulation, distribution, and the laws of supply and demand, you start trading with the Composite Man instead of against him.

If you take away one thing, it's this: watch what smart money does, not what retail traders say. The footprints are always there for those who know how to read them.